All About Thomas Insurance Advisors

Wiki Article

Not known Incorrect Statements About Thomas Insurance Advisors

Table of ContentsRumored Buzz on Thomas Insurance AdvisorsThe Buzz on Thomas Insurance AdvisorsAll About Thomas Insurance AdvisorsThe 4-Minute Rule for Thomas Insurance AdvisorsSome Ideas on Thomas Insurance Advisors You Should KnowSee This Report about Thomas Insurance Advisors

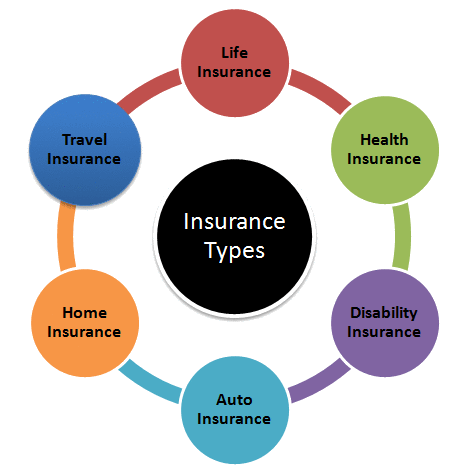

Auto insurance coverage is a plan that covers you in situation of accidents or other cases including your vehicle. It can cover damages to your auto and obligation for any kind of injuries or building damages you may trigger. Several sorts of vehicle insurance policy consist of obligation, accident, and also extensive insurance coverage. An annuity is an economic product that provides a surefire income stream for a collection period of life.Accident insurance coverage is a plan that provides financial payment in situation of injury or fatality. It can cover clinical expenditures, lost income, and other accident-related expenses. Special needs insurance coverage is a plan that offers monetary support in situation you come to be unable to function as a result of a health problem or injury. It can cover a part of your revenue and also assist you to cover your living expenditures.

Knowing that your last expenditures are covered can supply tranquility of mind for you and your liked ones.

The Basic Principles Of Thomas Insurance Advisors

It can cover regular appointments along with unforeseen health problems or injuries. Traveling insurance policy is a plan that provides financial protection while you are traveling - Annuities in Toccoa, GA. It can cover journey terminations, lost travel luggage, medical emergency situations, and also various other travel-related expenditures. Traveling clinical insurance policy is a plan that especially covers clinical costs while taking a trip abroad.

Therefore, it can safeguard circumstances where the liability limits of various other policies are gone beyond. Dental insurance is a plan that covers the expense of dental treatment, consisting of regular appointments, cleanings, as well as much more comprehensive oral treatments. It can likewise cover orthodontic therapy, such as dental braces. These are just a few of one of the most common sorts of insurance coverage.

Some Ideas on Thomas Insurance Advisors You Need To Know

If you have any type of inquiries about insurance, call us and also ask for a quote. They can help you select the appropriate policy for your needs. Contact us today if you desire personalized service from a certified insurance representative.Below are a few factors why term life insurance coverage is the most preferred type. The price of term life insurance coverage costs is identified based on your age, wellness, and the insurance coverage amount you call for.

HMO plans have reduced regular monthly costs and also lower out-of-pocket expenses. With PPO strategies, you pay higher regular monthly costs for the liberty to utilize both in-network and also out-of-network companies without a reference. PPO strategies can lead to greater out-of-pocket medical expenses. Paying a premium resembles making a month-to-month car repayment.

Thomas Insurance Advisors - The Facts

When you have a deductible, you are in charge of paying a certain amount for coverage solutions before your health insurance plan provides protection. Life insurance policy can be divided right into two major kinds: term and irreversible. Term life insurance policy offers insurance coverage for a certain duration, commonly 10 to thirty years, and is extra cost-effective.This content is for informative objectives only and may not be relevant to all circumstances. Insurance coverage subject to terms, problems, and also availability. Plan issuance undergoes credentials. Allstate Insurer, Allstate Indemnity Business, Allstate Fire and also Casualty Insurer, Allstate Residential Property and Casualty Insurance Provider, Allstate North American Insurance Firm, Northbrook, IL.

Some Ideas on Thomas Insurance Advisors You Need To Know

According to information from 2019, a car mishap could cost you even more than $12,000, even without any kind of injuries; it can set you back more than $1. These expenses come from clinical expenses, car damages, wage and also performance losses, as well as more.These insurance coverages pay for clinical expenditures connected to the incident for you and also your passengers, regardless of who is at mistake. This also assists cover hit-and-run accidents and also collisions with chauffeurs that don't have insurance coverage. If you're acquiring a vehicle with a loan, you might also need to include comprehensive as well as crash coverage to your policy to spend for damages to your car as a result of automobile crashes, burglary, vandalism, and also other dangers. https://trello.com/u/jstinsurance1.

For many people, a house is their biggest possession. House insurance policy shields you by offering you an economic safety net when damage happens. If you have a home mortgage, your lender possibly needs a plan, yet if you do not buy your own, your loan provider can buy it for you and send you the expense.

The smart Trick of Thomas Insurance Advisors That Nobody is Talking About

Residence insurance policy is a great idea, also if check my blog you've repaid your mortgage, due to the fact that it shields you versus costs for residential property damage. It also protects you against obligation for injuries as well as property damages to visitors caused by you, your family, or your pets. It can likewise cover you if your residence is unliveable after a protected case, and also it can pay to repair or reconstruct detached frameworks, like your fence or shed, harmed by a covered insurance claim.Report this wiki page